prince william county real estate tax assessment

Free Prince William County Treasurer Tax Collector Office Property Records Search. News from San Diegos North County covering Oceanside Escondido Encinitas Vista San Marcos Solana Beach Del Mar and Fallbrook.

Prince William County Launches A New Show Called County Conversation

All real property in Prince William County except public service properties operating railroads interstate pipelines and public utilities is assessed annually by the Real Estate Assessments Office.

. Our Law and Daily Life blog is here to answer questions about family issues real estate accidents and injuries immigration workplace law and much more. CARROLL COUNTY ASSESSMENT OFFICE. A property tax or millage rate is an ad valorem tax on the value of a property.

Prince William County Stats for Property Taxes For an easier overview of the difference in tax. CAROLINE COUNTY ASSESSMENT OFFICE Keith C. REAL ESTATE Real Estate - per 100 of valuation Base Rate 1115 Fire and Rescue Levies Countywide except for the Town of Quantico 00800 Mosquito and Forest Pest Management previously Gypsy Moth 00025.

Often a property tax is levied on real estate. 200 Duke St Prince Frederick MD 20678. Landry Parish has the lowest property tax in the state collecting an average tax of 202.

Occoquan Fairfax Prince William - - - -. Real Estate Tangible Personal Property Machinery and Tools Merchants Capital Table 3 Rates of Town Levies for Town Purposes for Tax Year 2018 FY2019 TOWN COUNTY Tax Rates Per 100 of Assessed Value On. Enter the house or property number.

If you are using an Independent Delivery Service you must use an Internal Revenue Service designated delivery service or one that has been approved by the Los Angeles County Tax Collector. LOS ANGELES COUNTY TAX COLLECTOR PO. William Donald Schaefer Tower 6 Saint Paul St 11th Floor Baltimore Maryland 21202-1608 Hours.

800 to 500 410 767-8250 FAX 410 333-4626 E-mail. Everyday life is full of challenges requiring basic legal knowledge. Real estate in Prince William County was most recently reassessed as of 2019 which means current assessed values may be close to full market value.

Churchill Downs Inc the Louisville Kentucky-based owner of the Kentucky Derby has agreed to purchase The Rose a forthcoming 389 million gaming resort in Prince William County along with the. Prince William County Property Records are real estate documents that contain information related to real property in Prince William County Virginia. The average effective property tax in the county is 105.

The exact property tax levied depends on the county in Louisiana the property is located in. The tax is levied by the governing authority of the jurisdiction in which the property is located. Use both House Number and House Number High fields when searching for range of house numbers Street Name.

Available for parcel and premise address features click this button to return additional information pertaining to the subject features location. If you have questions about this site please email the Real Estate Assessments Office. Sdatbaltcitymarylandgov Reassessment Year Map.

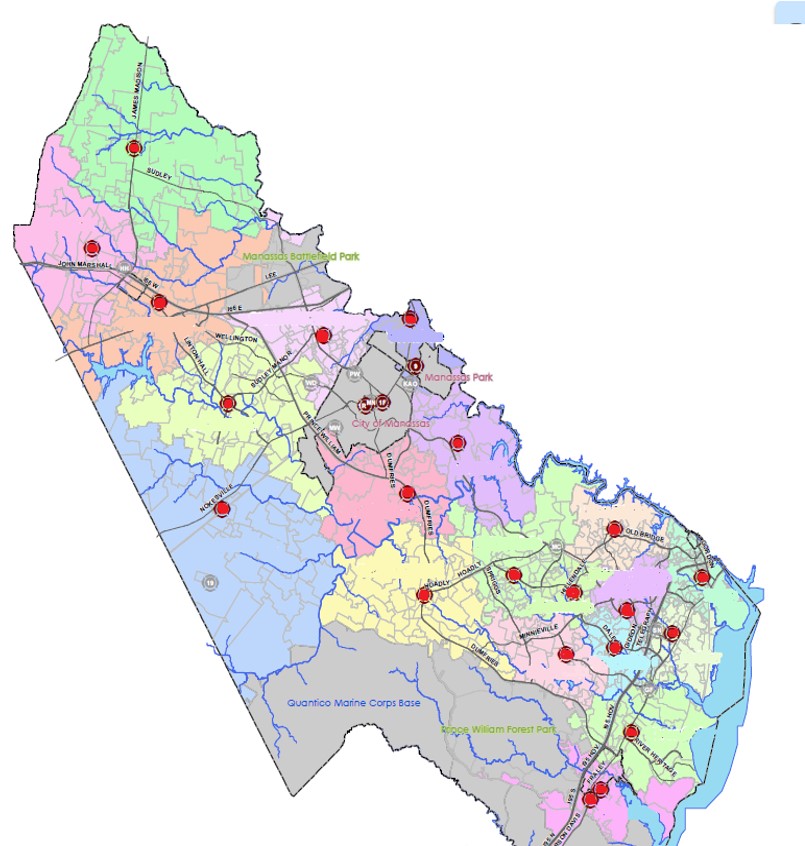

BOX 54018 LOS ANGELES CA 90054-0018. Find Prince William County residential property records including owner names property tax assessments payments rates bills sales transfer history deeds mortgages parcel land zoning structural descriptions valuations more. Prince William County is a largely suburban county situated on the Potomac River southwest of Washington DC.

The Assessments Office will mail the 2022 assessment notices in early March. Available for parcel features click this button to retrieve tax information about the subject parcel by launching an instance of the Real Estate Assessment web application. Enter street name without street direction NSEW or suffix StDrAvetc.

Bobbick Supervisor of Assessments 410 819-4450. For more information please visit Prince William Countys Department of Real Estate Assessments or look up this propertys current valuation. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

Sdatcrlnmarylandgov Hargreaves District CourtMulti-Service Center 207 South Third St Denton MD 21629. This can be a national government a federated state a county or geographical region or a municipalityMultiple jurisdictions may tax the same property. Tammany Parish collects the highest property tax in Louisiana levying an average of 133500 066 of median home value yearly in property taxes while St.

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Rural Crescent In Prince William County

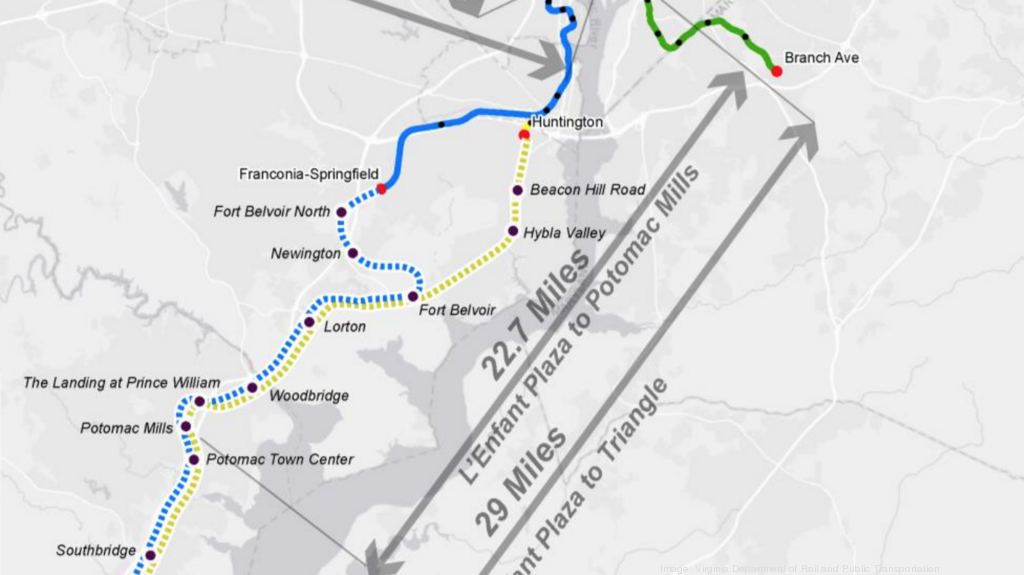

Here S How Metro Would Change Prince William County Development With A Quantico Extension Washington Business Journal

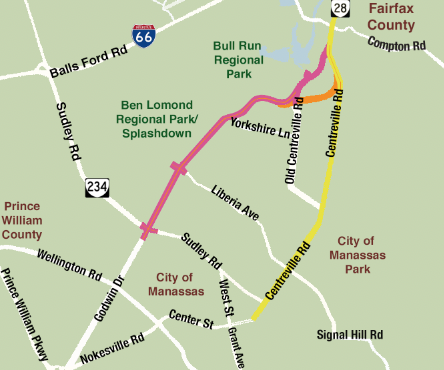

Prince William Area Leaders Call For Reconsideration Of Route 28 Bypass Headlines Insidenova Com

Prince William County Sheriff S Office Wikiwand

Prince William County Sheriff S Office Wikiwand

Police Basic Recruit School Graduates Today

Prince William County Sheriff S Office Wikiwand

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenova Com

Here S How Metro Would Change Prince William County Development With A Quantico Extension Washington Business Journal

Class Specifications Sorted By Classtitle Ascending Prince William County

Prince William County Pledges New Protections For Old Cemeteries News Fauquier Com

Prince William County Sheriff S Office Wikiwand

Here S How Metro Would Change Prince William County Development With A Quantico Extension Washington Business Journal